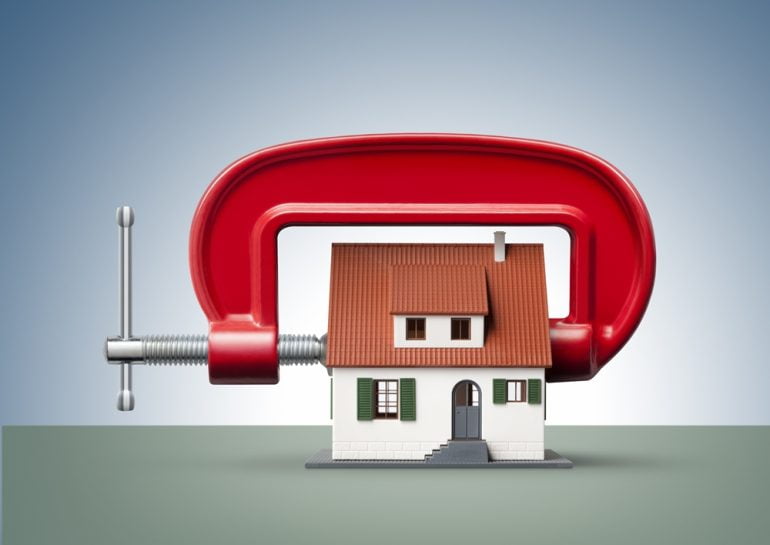

Stricter rules around qualifying for a mortgage could be coming as Canada’s banking regulator seeks feedback on several proposals to limit the number of overstretched borrowers.

The proposals out Thursday from the Office of the Superintendent of Financial Institutions (OSFI) come as part of the first stage of a wide-ranging review of the B-20 mortgage underwriting rules the regulator is conducting this year.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link